Quoted from MarketWatch:

Published: Oct. 30, 2023 at 1:26 p.m. ET

You can earn high yields on municipal bonds right now, while avoiding risk in the stock market.

If you are an investor, assumptions built up during decades of low bond yields now have to go out the window. Interest rates are now high enough that you can get compelling returns on municipal bonds, if you take tax advantages into account.

This assumes of course that you are paying high-enough income taxes that avoiding them is worthwhile. Early in October we looked at exchange-traded funds that invest in municipal bonds paying interest that is exempt from federal income taxes. We also dug into two high-tax states, because if you (or your ETF) hold tax exempt bonds issued within your state, the interest is also exempt from state and local income taxes.

But bond funds also have fluctuating share prices. If you hold an individual bond until maturity (or until it is called, as explained below), you don’t have to worry about how much its market value fluctuates. (Bond prices fall as interest rates rise and vice versa.) You know the price you will pay, so your only risk is that of default, which is rare for municipal bonds. And that risk can be mitigated by sticking with investment-grade-rated securities.

According to Lewis Altfest, CEO of Altfest Personal Wealth Management in New York, municipal bonds “are very attractive right now.”

“The spreads have narrowed between Treasury bonds and munis,” he said during an interview with MarketWatch.

Dan Genter CEO of Genter Capital Management in Los Angeles, also talked about the dynamic bond market in a separate interview with MarketWatch: “It is pretty amazing. In 17 months you went back to where you were 17 years ago. It is nice to have some income and have some yield — to be in a situation where you’re making money.”

Altfest and Genter provided examples of investment-grade bonds issued in four high-tax states: California, New York, New Jersey and Illinois.

Here’s a very simple taxable equivalent calculation making use of the highest-yielding bond among the examples provided by Altfest and Genter:

· The market yield on 10-year U.S. Treasury bond notes BX:TMUBMUSD10Y was 4.88% early on Monday.

· Genter provided an example of a municipal bond backed by the revenue of Chicago Midway International Airport. This bond doesn’t have a call date. Its coupon is a fixed 5% and it matures in 2030. The CUSIP is 167562RU3. It is priced at 101.953. Its yield to maturity is 4.63%, according to Bloomberg. The interest paid is exempt from federal income taxes but is subject to state income taxes.

If the investor is in the 24% federal income-tax bracket, we can calculate the taxable-equivalent yield for the Chicago Midway bond by dividing its YTM of 4.63% by 1 less the tax rate. So 4.63% divided by 0.76 gives us a taxable-equivalent yield of 6.09%.

On a yield basis, this investor is better off with the municipal bond. And if they investor is in the 37% federal tax bracket, we divide the bond’s YTM of 4.63% by 0.63 for a taxable-equivalent yield of 7.35%.

Altfest said taxable equivalent yields on munis above 7% are “close to equity-type returns,” which seem “good, especially now.”

Genter pointed out that for some investors, it might be easier if they do the reverse — apply the tax rate to the taxable yield. In other words, the after-tax yield for the 10-year Treasury yield is 4.88% multiplied by 0.76 for the investor in the 24% tax bracket, or 3.71%. For the investor in the 37% tax bracket, 4.88% multiplied by .63 is 3.07%, which is a pretty lousy yield in this environment.

Four high-tax states

Keep in mind that if you live in a state with no income tax, you have quite an advantage, being able to look for the best yields on municipal bonds issued in any state.

Altfest said that for his clients, he sticks with bonds that have high credit ratings. “We like AA or higher,” he said, referring to ratings by Standard & Poor’s. Generally a rating of BBB- or higher from S&P or Fitch Ratings is considered to be investment-grade. This would be the equivalent of a Baa3 rating from Moody’s. Fidelity breaks down the credit agencies’ ratings hierarchy.

Altfest added: “To us, a double-A in munis is much more attractive than a double-A in corporates.” This is because a municipal issuer who is facing financial difficulty can take steps that a corporate borrower cannot take, including increasing taxes. He also said that municipal credit quality is looking “good across the board right now.”

Genter said he and his staff were focused on A-rated municipal bonds as well as AA, but he also said that “you don’t get caught by surprise” with defaults in the municipal market because “you are getting a lot of visibility into any deteriorating conditions.” Some of the bonds rated below AA are still considered AA because they are insured through Build America Mutual, in what is known as a “BAM wrap.”

The following are examples within the four states provided by Altfest and Genter. They provided the pricing and yield information late last week.

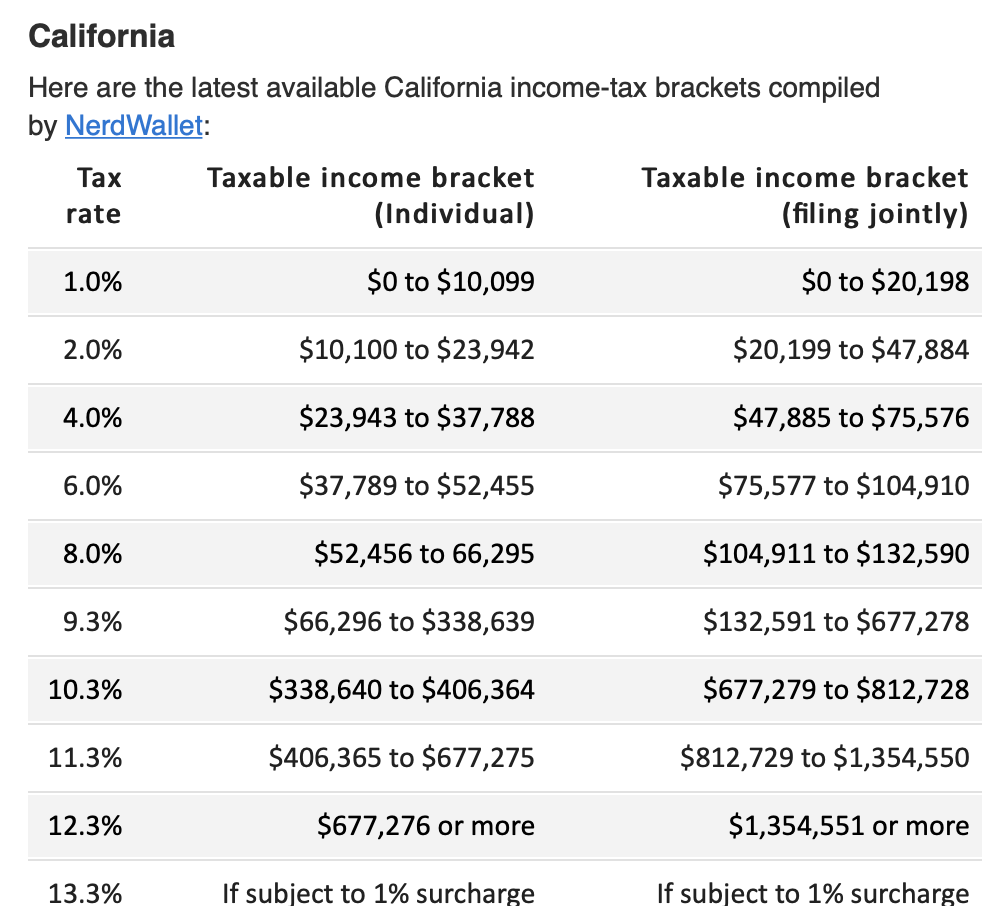

Each state with an income tax has its own income brackets that don’t match the federal brackets. So the best thing for an investor to do is to make their own taxable-equivalent calculations.

The highest bracket with the 1% surcharge is for California residents (filing individually or married couples) whose annual income exceeds $1 million.

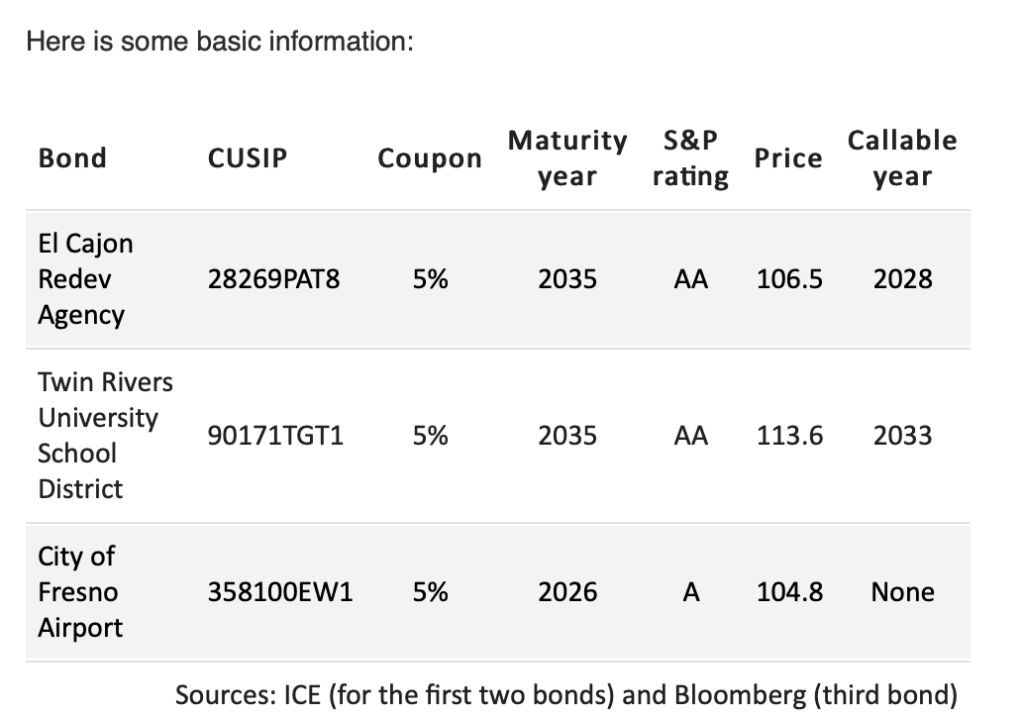

Here are three examples of municipal bonds issued in California that are exempt from state and local taxes. The first two were provided by Altfest, the third by Genter.

Genter said the A-rated Fresno Airport bond has a BAM wrap that makes it the equivalent to AA.

More about bond portfolio management

Genter said that he and his team “are always looking at yield to worst,” and the last table, showing bonds issued in Illinois illustrates the point, with the yields to call much lower than the yields to maturity.

The bond market’s yield curve has been inverted. Normally, the longer the maturity the higher the market yield. This has Genter to use a barbell strategy, with a higher percentage of bonds with maturities of one to three years, then a small weighting to intermediate maturities and “more out in the 10- and 15-year area.

Genter stressed that within client portfolios, bonds don’t normally sit until maturity. Instead, he and his team will adjust portfolios based on the market’s evolving yield curve and on credit quality, to get the highest total returns.

Altfest said he had been moving toward longer maturities, and “for something not callable for nine years, if we can get it, so we know we are locking in a rate that would benefit from any decline in interest rates, because of a recession or just a letting up by the Federal Reserve.”

Click Here To View The Full Article

If you have trouble opening full article and would like to receive it please contact us.